First off, I’d like to say that Wise.com is the best solution out there for banking when dealing with International Payments as a business and has dramatically reduced friction & bankings costs for me.

One of our next goals is to integrate the wise transactions, and in the future, integrate making payment from the Enlivy Application through Wise.

How the integration plan started

Every month, I have to send my accountant every invoice that interacted with the company, both issued and incoming. Part of the plan is to make this process simple and convenient through Enlivy, a one-click interaction.

Every three months, I need to send the Banking Statement for the Quarter, and every time I need to do it, I get pissed simply because it’s repetitive.

Right now, we’re running four bank accounts at Enlivy, 3 through Wise and 1 through Raiffeisen. I spend around 15 – 30 minutes getting all the statements and sending them to my accountant every three months.

Making this a one-click thing from a user perspective is more challenging than taking all the invoices and just zipping them, as everything will happen in the software.

In the application, incoming invoices need to be uploaded in the system and assigned ( optionally ) an issuer. In the future, we’re planning to detect if any invoices are missing from the system by checking the Bank Statements and assigning transactions to invoices ( outbound or inbound)

We’ll make it convenient in the Enlivy application to request all the quarterly bank statements in one go and ZIP them, in the start, with Wise.com, and later on, we’ll add support for more Banks.

This type of feature will be available based on jurisdiction.

By integrating Wise.com, we’re supporting a Global Audience, which is convenient to start. Still, as mentioned previously, the end goal is to connect banks in every country that the software will support.

Monitoring wise transactions

- Payroll System

- Inbound Invoices

- Outbound Invoices

- Custom Labels, useful when not assigned to an entity in the system, can be used even if it’s part of an entity.

As the Enlivy API is all about giving you control over your data, the API will make it simple for you to retrieve all your banking transactions.

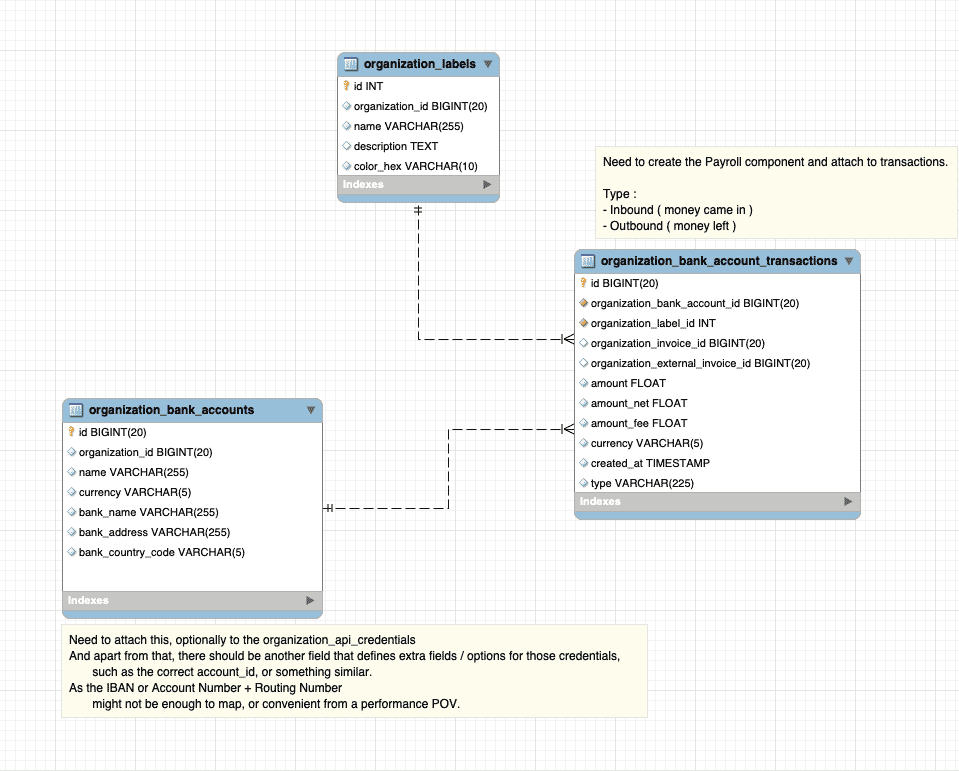

The v0.1 plan for transactions looks like this, we’re still exploring the wise API, and the schema is just a starting reference point:

What about sending payments?

That’s also on the roadmap, the focus will be to integrate mandatory 2FA ( Two Factor Authentication ), where 2 of 3 systems need to be used.

- Email Authentication ( a code is received on the email )

- Phone SMS Authentication ( a code is received on the phone )

- Google Authenticator

Security is, and will always be one of our biggest concerns, the goal of the Enlivy application when talking about payments is doing Multiple Bulk Payments, such as Payroll Payments, and paying a batch of invoices in one go, doing all these operations will be more effective through one 2FA session, than doing it over and over again, for all the Transactions.

The system will also have a minimum wait time of 10 minutes before the payments are processed, and during this time the operation can be canceled.

All bank accounts need to be whitelisted in advance when they’re enabled for the Mass Payments, and every account will have a maximum allowed limit of $ that they can receive through the mass payout system.

What’s next?

Well, we’ve just started out building this feature, and I cannot wait for it to see fruition.

In the meantime, we’re been busy implementing personality tests in the API, and are currently working on the front end of the application.

We’ve already finished two integrations, one of them being the Big Five Test.

The application will be available on our website, and for Personality Tests, our plan is to allow embedding them on any WordPress powered website, through a special integration Plugin.

Your success story begins with our tailored solutions!

Our team specializes in crafting tailored solutions to meet your unique challenges and goals, providing you with the expertise you need to succeed.