The world watched with bated breath as unprecedented sanctions rained down on Russia following its invasion of Ukraine. Experts predicted economic collapse, a plummeting ruble, and a crippled military machine. However, to everyone’s surprise, Russia has shown surprising resilience. While the long-term effects remain, one factor stands out – Russia’s strategic use of its gold reserves.

Russia’s Rise as a Gold Powerhouse

Russia boasts a long and storied history of gold production, dating back centuries to the czars. Today, it’s a dominant force in the global gold market. According to the World Gold Council, Russia is the world’s second-largest gold producer, trailing only China. In 2023, Russia produced a staggering 324.7 metric tons of gold, with forecasts predicting a steady 4% annual increase until 2026. This significant production capacity gives Russia a powerful economic lever, but it’s not just about the quantity; it’s about strategic utilization.

In a bold move in February 2022, Russia took a step unseen in the modern world – pegging its currency, the ruble, to gold. This act essentially tied the ruble’s value directly to the price of gold, aiming to create stability amidst the economic turmoil caused by sanctions. Before this move, the ruble had experienced significant devaluation due to sanctions and global inflation. The ruble’s value plummeted to historic lows, causing panic buying and a potential economic meltdown. Pegging the ruble to gold gave Russian citizens and businesses a sense of security. Gold is generally considered a more stable asset than fiat currencies, and by linking the ruble to gold, Russia aimed to create a more reliable foundation for its economy.

Bypassing Sanctions: The Free Flow of Russian Gold

A crucial aspect of Russia’s gold strategy lies in its ability to freely trade its existing gold reserves on the global market. Gold is not subject to the same restrictions, unlike many other sanctioned goods and materials. This loophole allows Russia to access a significant financial resource despite the sanctions.

The West sanctioned Russia in many sectors, but the gold market remained largely untouched, allowing Russia to continue trading its gold reserves. China and India continued to do business with Russia, boosting its ability to bypass sanctions through gold sales.

Impact on Global Prices and the Future of Currencies

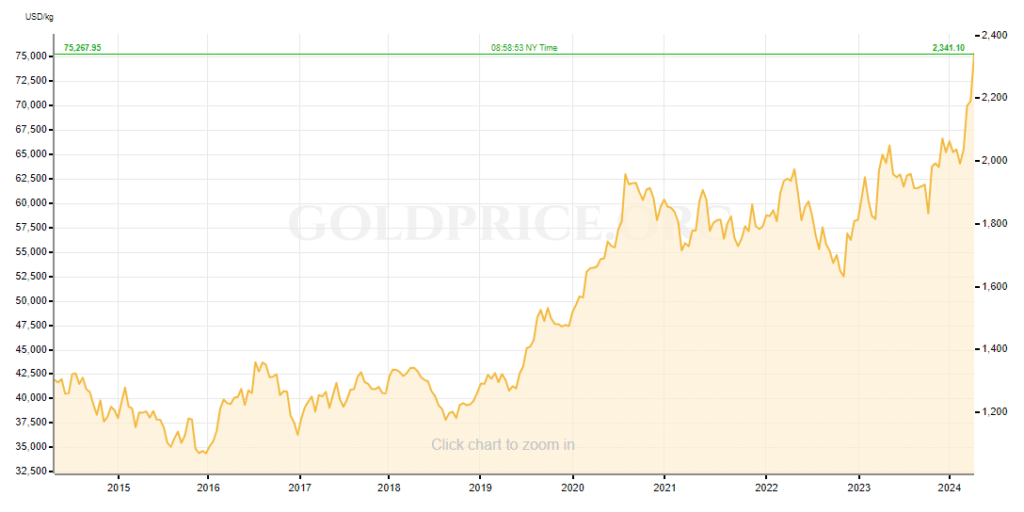

The free flow of Russian gold, coupled with a global trend of central banks stockpiling gold as a safe-haven asset, has significantly impacted gold’s price. Over the past few months, gold prices have reached record highs, fueled by this increased demand. Data from the World Gold Council shows that central banks worldwide purchased over 1,100 metric tons of gold worldwide in 2022 alone. This trend continued in the first quarter of 2023, with central banks remaining active buyers of gold. This global stockpiling and Russia’s strategic gold sales have undoubtedly contributed to the rise in gold prices.

A Multipolar World and the Decline of the US Dollar’s Dominance?

The rise of gold and the increasing importance of alternative trading partners for Russia point towards a potential shift in the global financial landscape.

The US dollar has traditionally been privileged as the world’s primary reserve currency. This dominance is due to several factors, including the size and stability of the US economy, the deep and liquid US Treasury market, and the historical role of the US dollar in global trade. However, a potential challenge to the dollar’s dominance is emerging with countries like China diversifying their reserves by increasing their gold holdings and decreasing their US dollar reserves.

Data Points Highlighting the Shift:

- China’s Strategic Reserve Diversification: China has steadily reduced its holdings of US Treasuries in recent years. Data from the US Department of the Treasury shows that China’s holdings of US Treasuries dropped from $1.39 trillion in 2013 to $870 billion in 2023. This decrease coincides with China’s increase in gold holdings, suggesting a shift in its reserve strategy.

- Beyond China: Countries like Brazil and Russia have also expressed concerns about the overreliance on the US dollar in global trade. Brazil’s President Lula da Silva has called for creating a new international reserve currency not tied to any one country. Other countries seeking to reduce their dependence on the US dollar and explore alternative reserve currencies echo this sentiment.

The Potential Impact of a Multipolar Reserve System:

The potential decline of the US dollar as the world’s primary reserve currency is a complex issue with far-reaching consequences. Here’s a breakdown of some potential impacts:

- Increased Volatility: A multipolar reserve system could increase exchange rate volatility, making international trade and investment more complex and potentially riskier.

- Reduced US Influence: The US dollar’s dominance has historically given the US significant economic and political leverage on the global stage. A decline in the dollar’s dominance could weaken this influence.

- Emergence of New Power Centers: A multipolar reserve system could lead to new power centers in the global financial system, with countries like China potentially playing a more prominent role.

Challenges and Uncertainties for Russia’s Golden Gambit

While Russia’s gold strategy has shown some initial success, it faces several challenges and uncertainties:

Sustainability of Gold Production: While Russia boasts significant gold reserves (estimated at over 7,400 metric tons), its ability to continue producing gold at current levels could be hampered by factors such as:

- Technological Dependence: Modern gold mining relies heavily on specialized equipment and technology. Sanctions could restrict Russia’s access to these resources, hindering its ability to maintain or increase production.

- Skilled Labor Shortage: Gold mining requires a skilled workforce. If sanctions or brain drain lead to a shortage of qualified workers, Russia’s gold production could suffer.

- Investment Constraints: The gold mining industry is capital-intensive. Sanctions could limit Russia’s access to investment capital needed to maintain or expand its gold mining operations.

- Evolving Sanctions Landscape: The current loopholes exploited by Russia in the sanctions regime may not last forever. Here are some potential developments:

- Closing Loopholes: Western countries could tighten sanctions to explicitly target the gold market, making it more difficult for Russia to freely trade its gold reserves.

- Secondary Sanctions: Western countries could impose secondary sanctions on countries that continue to trade with Russia, particularly in the gold market. This could deter some of Russia’s current trading partners.

A Golden Dawn or a Looming Storm?

The recent surge in global gold prices is a complex phenomenon fueled by economic and geopolitical factors. While Russia’s strategic use of its gold reserves has undoubtedly contributed to the surge, the bigger story lies in the broader market dynamics.

Gold’s timeless allure as a hedge against uncertainty continues to drive investor behavior. The global economic slowdown and ongoing geopolitical tensions have created an environment where investors seek stability and a refuge for wealth. Gold, with its historical performance during crises, perfectly fits this bill.

Central Banks Take Center Stage

Individual investors do not solely drive the surge in demand. Central banks worldwide, particularly those in emerging economies, have been actively stockpiling gold reserves. This shift in reserve strategies reflects a desire for diversification and a hedge against potential currency fluctuations. This unprecedented level of central bank buying has undeniably contributed to the rise in gold prices.

Monetary Policy and Inflation Expectations

Low interest rates make gold a more attractive option compared to interest-bearing assets. Furthermore, concerns about rising inflation due to recent stimulus measures have driven investors towards gold as a hedge against purchasing power erosion.

The future trajectory of gold prices remains uncertain. The global economy’s path, the effectiveness of monetary policies, and the resolution of geopolitical tensions will all determine the fate of gold prices.

Investing Wisely in a Golden Age?

While gold presents itself as a potentially attractive option in this volatile environment, careful consideration is necessary. Investors must assess their risk tolerance and investment goals before allocating capital to gold or any other asset class. As with any investment, thorough research and professional advice are crucial for navigating the ever-changing market landscape.

In conclusion, the global price of gold has reached a historic peak, reflecting a complex interplay of factors beyond Russia’s strategy. While a golden dawn may beckon for some, a looming storm of economic and geopolitical uncertainty hangs overhead. Only time will tell if this golden era is a beacon of stability or a fleeting moment in a world navigating uncharted territory.

Your success story begins with our tailored solutions!

Our team specializes in crafting tailored solutions to meet your unique challenges and goals, providing you with the expertise you need to succeed.