Over the past three years, we’ve meticulously crafted Enlivy, an API-powered SaaS solution designed to revolutionize business administration. Built with an API-first approach, Enlivy empowers you to streamline core back-office functions and gain valuable insights.

Key features include:

- Effortless Business Management: Simplify daily tasks from inventory management and product listings to generating invoices and processing payments.

- Automated Workflows: Automate repetitive tasks like bank transaction imports and data updates, freeing up your time to focus on strategic initiatives.

- Data-Driven Decision Making: Gain real-time insights into your business performance with intuitive reporting tools.

- Enhanced Efficiency: Eliminate manual processes and streamline workflows, boosting overall business efficiency.

- Flexibility & Scalability: Integrate Enlivy with your existing systems and scale your operations effortlessly as your business grows.

On-the-go Access

Enlivy is designed for on-the-go access. No software installations are required – simply log in from any web browser on your desktop, laptop, or even your phone! Access your company information and manage your business from anywhere, anytime, even while relaxing on the couch.

Main Features

In this session, we’ll dive into the heart of Enlivy and showcase some of its key features designed to streamline your daily operations. We’ll take a closer look at the intuitive dashboard, explore the effortless invoice management system, and walk you through handling transactions with ease. Through real-world examples, you’ll see firsthand how Enlivy can revolutionize the way you manage your business.

The Dashboard

The Enlivy dashboard is your command center, offering a customizable view of the key metrics that matter most to your business. Get a quick snapshot of vital information, and personalize the dashboard to prioritize the data that fuels your decision-making.

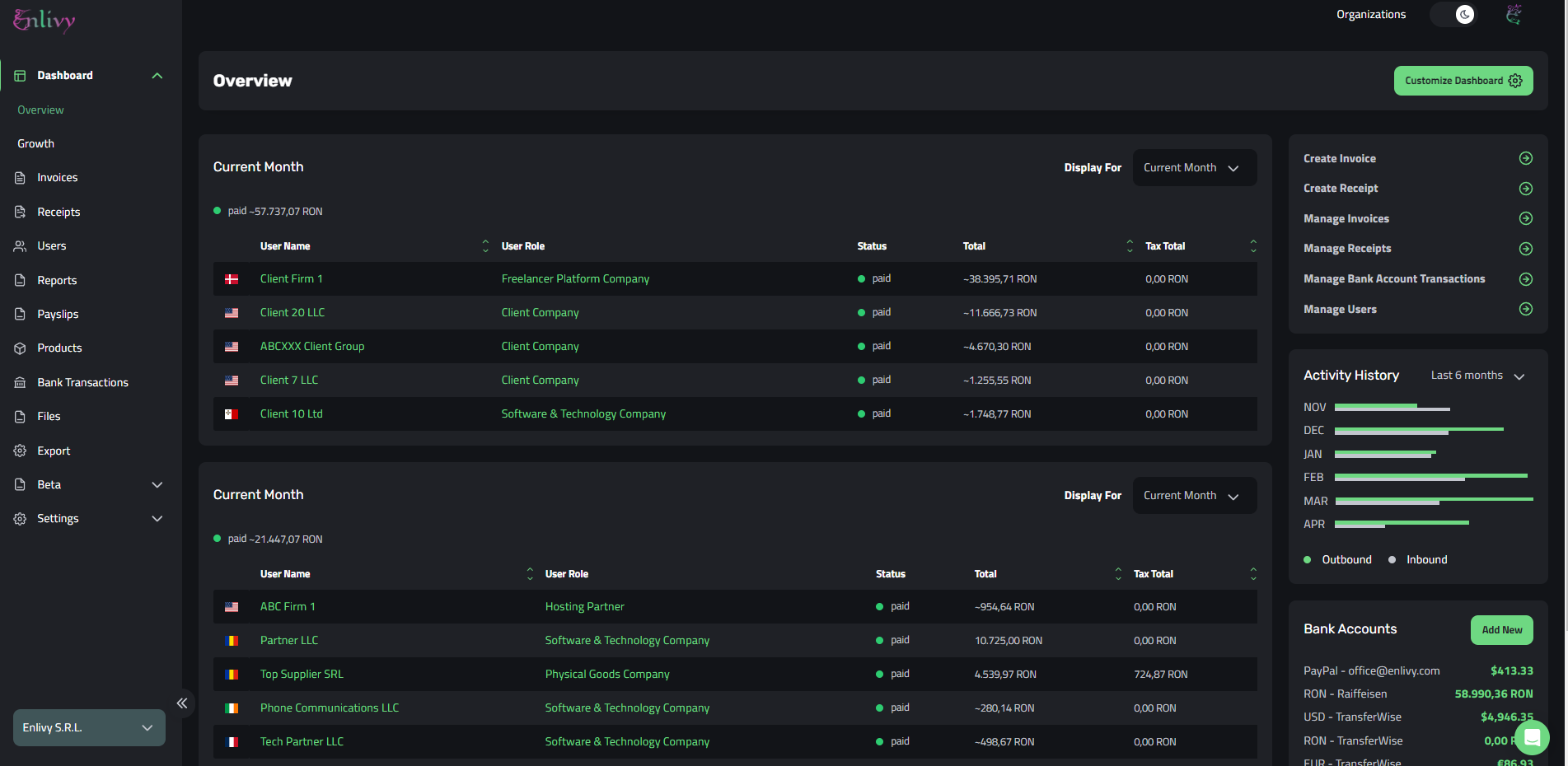

In the image above, we’ve set the Dashboard shows us vital information about our business in the current month:

- How much money we’ve spent and to whom

- How much earnings we’ve received from our clients

- A quick menu for: creating invoices/receipts, and managing different features (invoices, receipts, users, and bank account transactions)

- Our Activity History in the last 6 months

- Financial information about how much liquidity our firm has in its multiple bank accounts

Everything you see on the dashboard is completely customizable. You can even drag and drop the menu widgets to create a layout that perfectly suits your workflow and preferences.

The Invoice Hub

The Enlivy invoice module transforms invoice management into a streamlined and centralized experience. No matter if you’re sending invoices to clients (outbound) or receiving invoices from vendors (inbound), all your invoice activity resides within a single, user-friendly location.

The invoice module presents a conveniently paginated list, offering a quick snapshot of all your invoices. Each entry displays vital details, including the direction of the invoice (incoming or outgoing), a unique identifier for easy reference, the total amount due, the sender and recipient information (your company or your client’s company), the date the invoice was issued, the due date for payment, and the current invoice status (paid, overdue, etc.).

Enhanced Organization and Search:

- Effortless Invoice Navigation: Locate specific invoices with ease using the intuitive search bar. Simply enter relevant keywords or reference numbers to instantly find the information you need.

- Customizable Tagging System: For even more granular organization, leverage the power of Enlivy’s customizable tagging system. Create and apply tags to categorize your invoices based on project, client type, or any other criteria that suits your workflow. Utilize these tags to filter your invoice list, allowing you to effortlessly sort and view invoices based on the specific tags you assign.

- Downloadable PDF Invoices: For easy sharing with clients or record-keeping purposes, any invoice within the Enlivy system can be downloaded as a PDF file with a single click.

- Direct Invoice Editing: Need to make changes to an existing invoice? Enlivy empowers you to edit invoices directly within the platform, eliminating the need to re-enter data or switch between applications.

Adding an Invoice

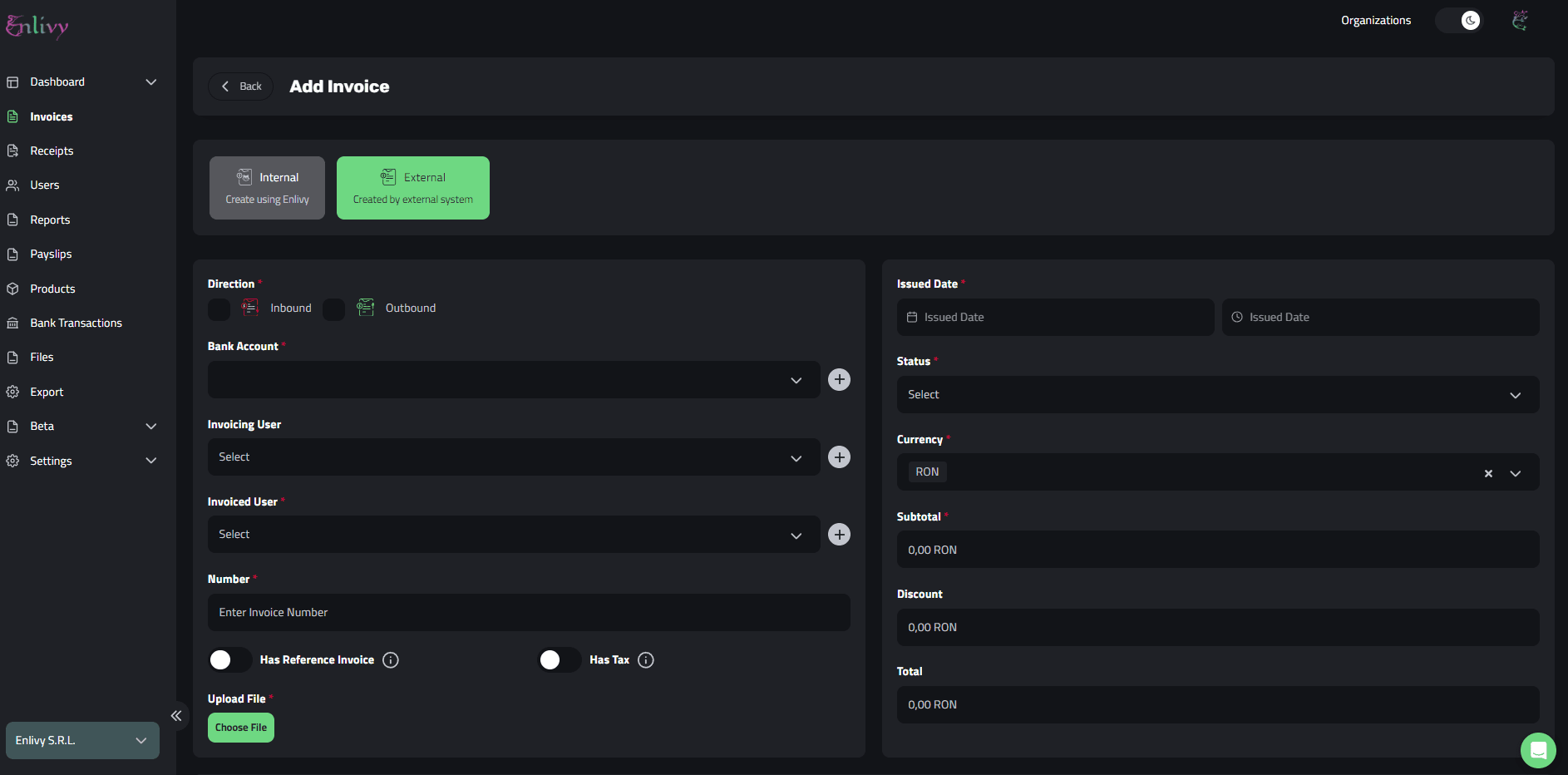

Adding invoices to Enlivy is a breeze! Here’s how it works:

- Click the “Add Invoice” button and choose your source:

- Select “Enlivy Invoice” if you created the invoice within the platform.

- Choose “External Invoice” if the invoice originated from another source.

Fill in the essential details:

- Direction: Specify whether the invoice is inbound (received from a vendor) or outbound (sent to a client).

- Bank Accounts: Indicate the bank accounts involved in the transaction, depending on the invoice direction (payment source or destination).

- Parties Involved: Clearly identify the invoiced user (who received the invoice) and the invoicing user (who sent the invoice).

- Invoice Details: Enter the unique invoice number for easy reference.

- Issue Date: Select the date the invoice was issued.

- Status: Indicate the current invoice status (paid, draft, scheduled, partially paid, etc.).

- Paid Date (if applicable): If the invoice has been paid, enter the payment date.

- Currency: Specify the currency used in the invoice.

- Subtotal: Enter the subtotal amount before taxes or discounts.

- Upload File (optional): Attach a copy of the invoice file (if available) for your records

Bank Transactions

Enlivy empowers you to streamline your bank transaction management with two convenient options:

- Automated Import with Nordigen: (Optional) Integrate Enlivy with Nordigen, a secure third-party service, to automatically import your bank transactions. This eliminates manual data entry and saves you valuable time.

- CSV File Upload: Simply upload a CSV file containing your bank transactions. Enlivy seamlessly imports the data, ensuring your financial records are up-to-date.

Seamless Invoice Matching

Once your transactions are imported, Enlivy makes it easy to connect them with your invoices. This intelligent matching ensures each expense or income is linked to the appropriate transaction, providing a clear and accurate picture of your finances.

Benefits:

- Effortless Data Entry: Say goodbye to manual data entry! Enlivy’s automated import options streamline the process.

- Enhanced Accuracy: Reduce the risk of errors with automatic or CSV-based transaction import.

- Clear Visibility: Gain a comprehensive understanding of your cash flow by effortlessly connecting invoices and transactions.

- Informed Decision-Making: Make data-driven financial decisions with real-time insights into your income and expenses.

Importing Bank Transactions from a CSV file

Importing your bank transactions into Enlivy is a simple process that gets you organized in minutes. Here’s how it works:

Grab your CSV file: Make sure you have your bank transactions exported in a CSV (comma-separated values) format. Most banks allow you to do this easily.

Initiate the import: Within Enlivy, navigate to the bank transaction import section and select your CSV file.

Become the master of your data: Enlivy provides a user-friendly interface to help you match the data points in your CSV file (date, amount, description, etc.) to the corresponding fields in the system. This is a straightforward process that ensures your financial information is imported accurately.

Relax, you’re all set! Once you’ve completed the import and data mapping, your bank transactions will be seamlessly integrated into Enlivy. This gives you a powerful central hub for all your financial data.

This is how the bank transactions information that we’ve uploaded will be displayed in Enlivy:

Managing Bank Transactions & Connection with Invoices

The Enlivy bank transactions section acts as your financial command center. It provides a consolidated view of all your imported or synced transactions, giving you a clear understanding of your cash flow. But Enlivy goes beyond simple transaction visibility. It empowers you to effortlessly connect these transactions to their corresponding invoices.

Imagine this: You receive a $1,000 USD deposit into your account. A few days prior, you sent an invoice for $1,000 to a client. Within Enlivy, you can seamlessly navigate to the bank transaction, click “connect,” and link it directly to the relevant invoice. This intuitive process ensures your income is automatically matched to the service it represents.

The power of connection doesn’t stop there. Similarly, you can connect outgoing transactions (expenses) to invoices you’ve paid. This streamlines your expense management and provides a clear audit trail for your financial records.

Benefits:

- Effortless Reconciliation: Save time and eliminate manual work by effortlessly connecting transactions to invoices.

- Enhanced Visibility: Gain a comprehensive picture of your cash flow by seeing how income and expenses are linked to specific invoices.

- Improved Accuracy: Reduce the risk of errors by ensuring your financial data is meticulously reconciled.

The next video will guide you through the seamless process of connecting a transaction initiated by one of our valued clients with the corresponding invoice we dispatched to them just days ago. This demonstration will showcase the simplicity and clarity of the process, ensuring smooth and efficient management of transactions and invoices.

In the above video, we had a bank transaction of 1250$, that we’ve connected with a invoice that was already added in the Enlivy App, and sent to our client.

Bank Transaction Cost Types

Enlivy offers users the convenience of creating and customizing specific bank transaction cost types to aid in classification. These personalized cost types serve as invaluable tools for characterizing various transactions, empowering users to efficiently categorize their banking activities with precision and ease.

Here are two examples of commonly used bank transaction cost types:

- Bank Fee: This classification is applied to fees charged by the bank for various services, aiding in the identification and management of banking-related expenses.

- Intra-Company Transfer: This category is employed for transactions involving the movement of funds between our company’s distinct bank accounts. It enables precise tracking and organization of internal financial transfers.

Adding A Custom Cost Type is easy and simple, like in the video below:

After Adding your new cost type, you can use it to define the transactions that you want, enabling you to easy filtering your bank transactions and keeping a record of the money in your organization.

This article provides an overview of the primary functionalities of the Enlivy app. Upon its full release, we will prepare comprehensive articles detailing each feature and capability of Enlivy, offering in-depth insights into its various functionalities and how they can benefit users. Stay tuned for more detailed information on Enlivy’s features and capabilities.

Your success story begins with our tailored solutions!

Our team specializes in crafting tailored solutions to meet your unique challenges and goals, providing you with the expertise you need to succeed.